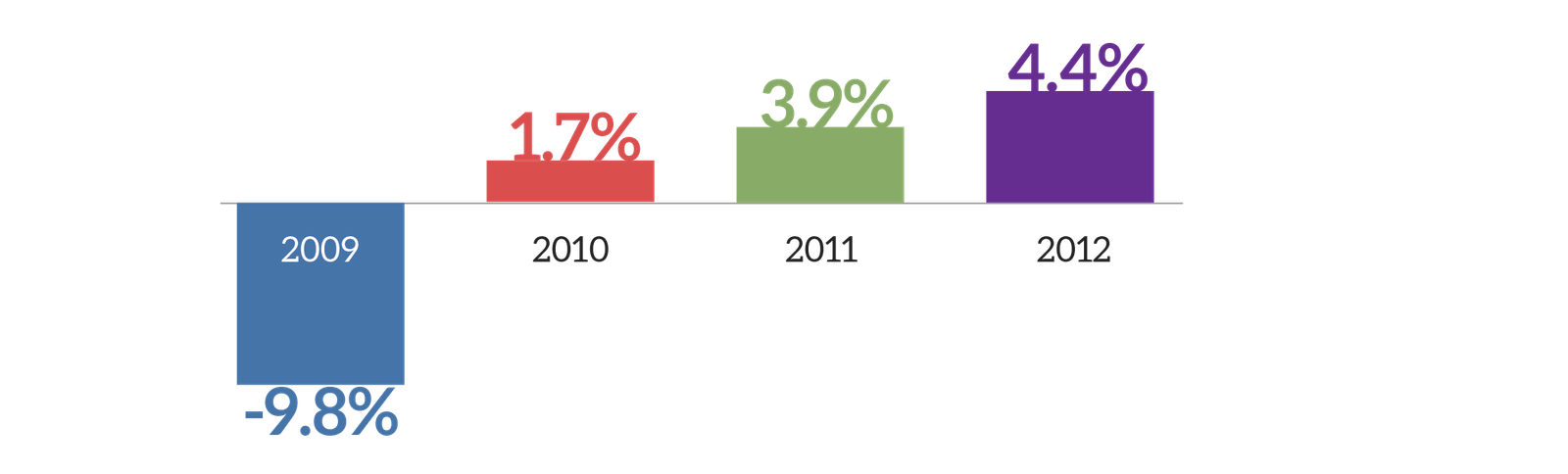

UAE is a very developed economy, classified as a high income country. GDP growth slowed dramatically during the 2009 global financial crisis but has since recovered, growing progressively stronger each year.

GDP Growth

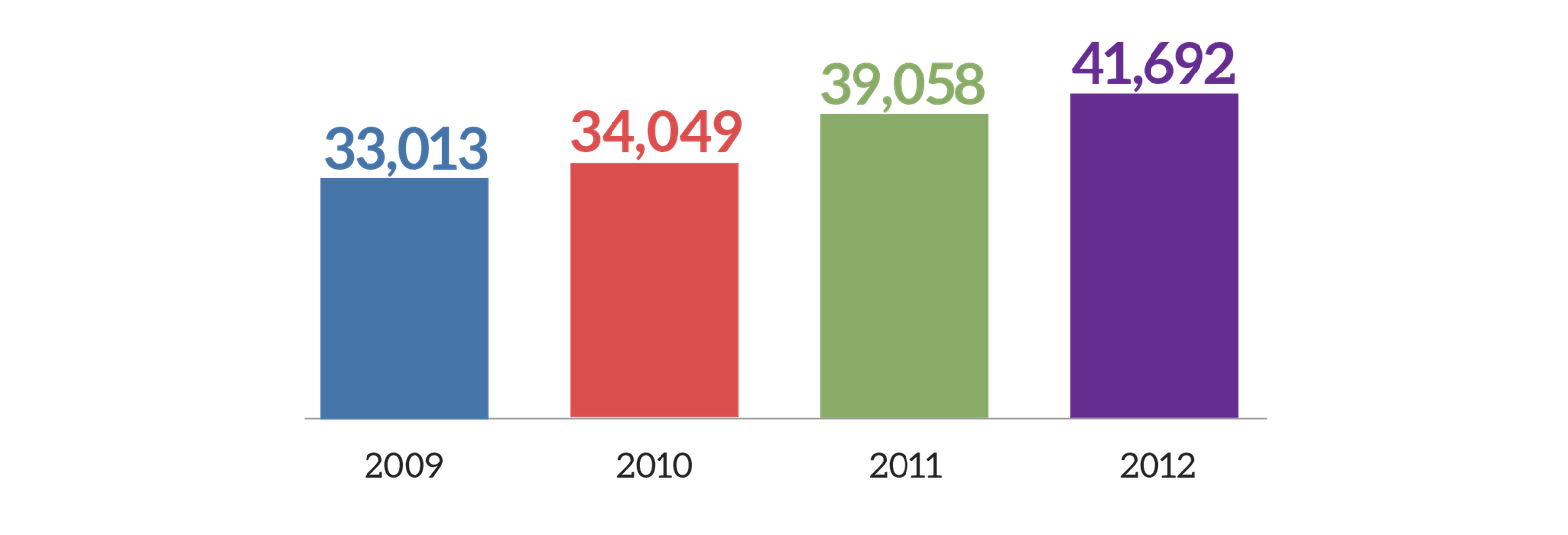

Along with its economic growth is a rapidly growing population, estimated at 5.5 million, an increase from the 3.2 million in 2002 at 5.7% CAGR. The country enjoys a high per capita GDP of $41,692 as of 2012.

GDP per Capita ($)

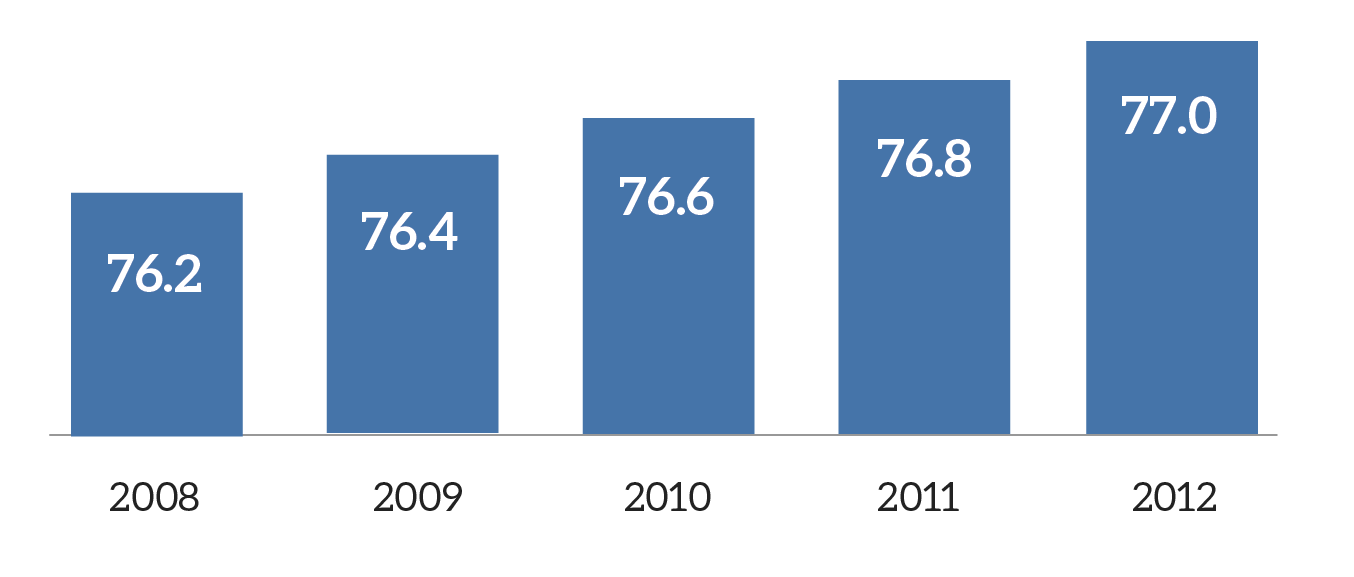

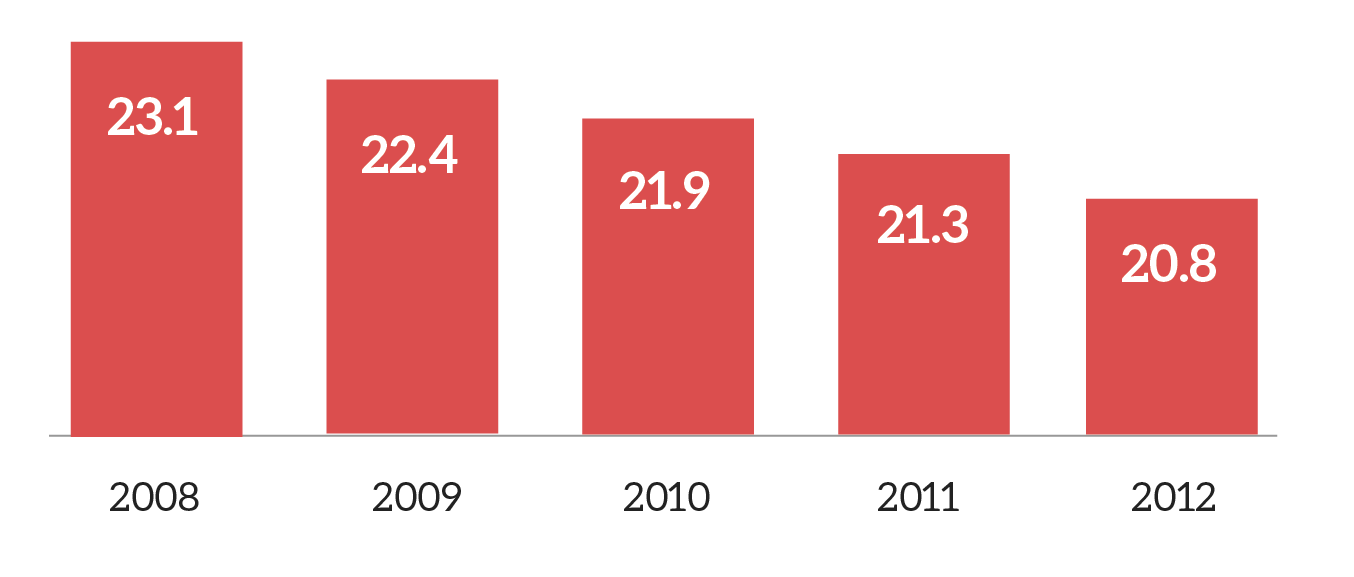

The growing affluence of the nation is a driving factor in the improvement of its health indicators through the years such as life expectancy, neonatal mortality and maternal mortality – indices used to determine human development level. UAE’s human development index (HDI) is above average in the Middle East and ranked 40th globally.

Life expectancy at birth (years)

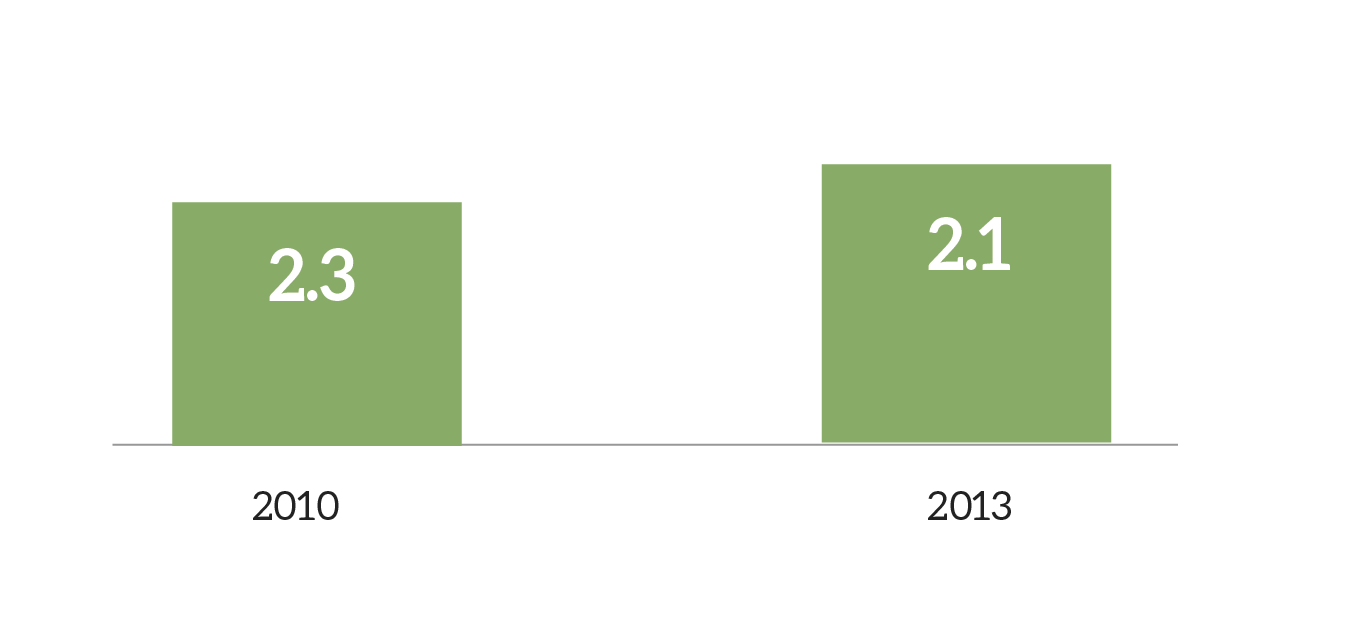

Neonatal mortality per 1000 live births

Maternal mortality per 1000 live births

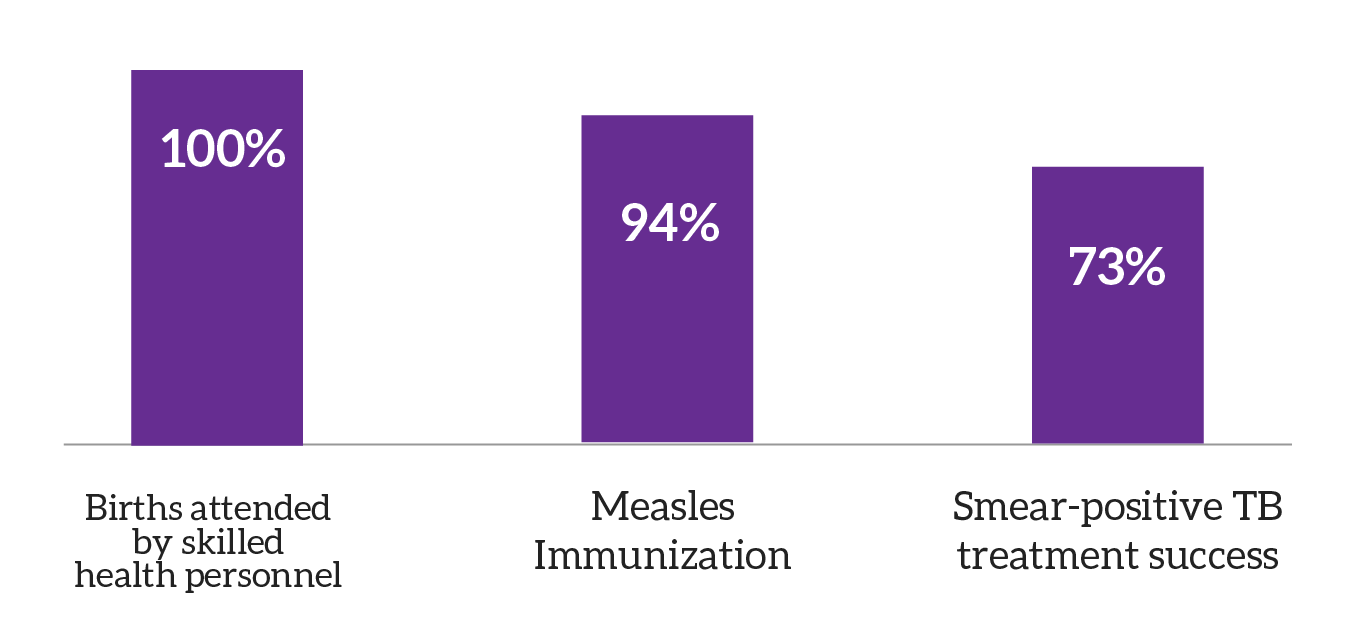

Utilization of Health Services

However, as major health indicators for human development improve, life-style diseases, usually related to urbanization and technologically-driven lifestyles, are also on the rise. Moreover, 20% of the adult population in 2012 is obese, putting the country seventh on the Global Fat Scale among 177 countries.

| Cardiovascular Diseases (such as hypertension/high blood, high cholesterol) | Cancer (prevailing types: breast, colon, lymphoma and prostate) | Respiratory Diseases (such as asthma, chronic obstructive pulmonary disease, allergic rhinitis) | Diabetes |

|---|---|---|---|

|

|

|

|

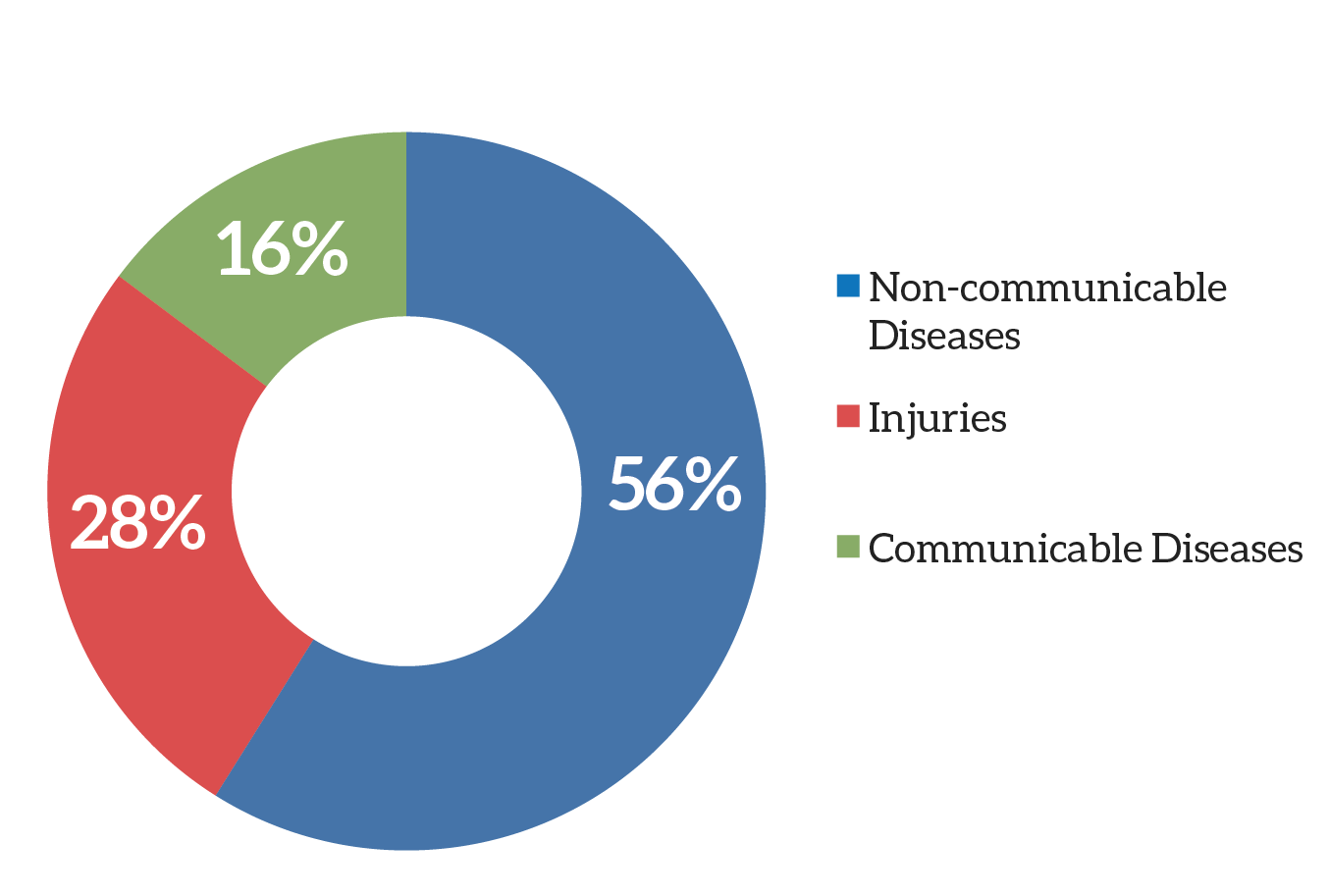

Distribution of years of life lost by causes

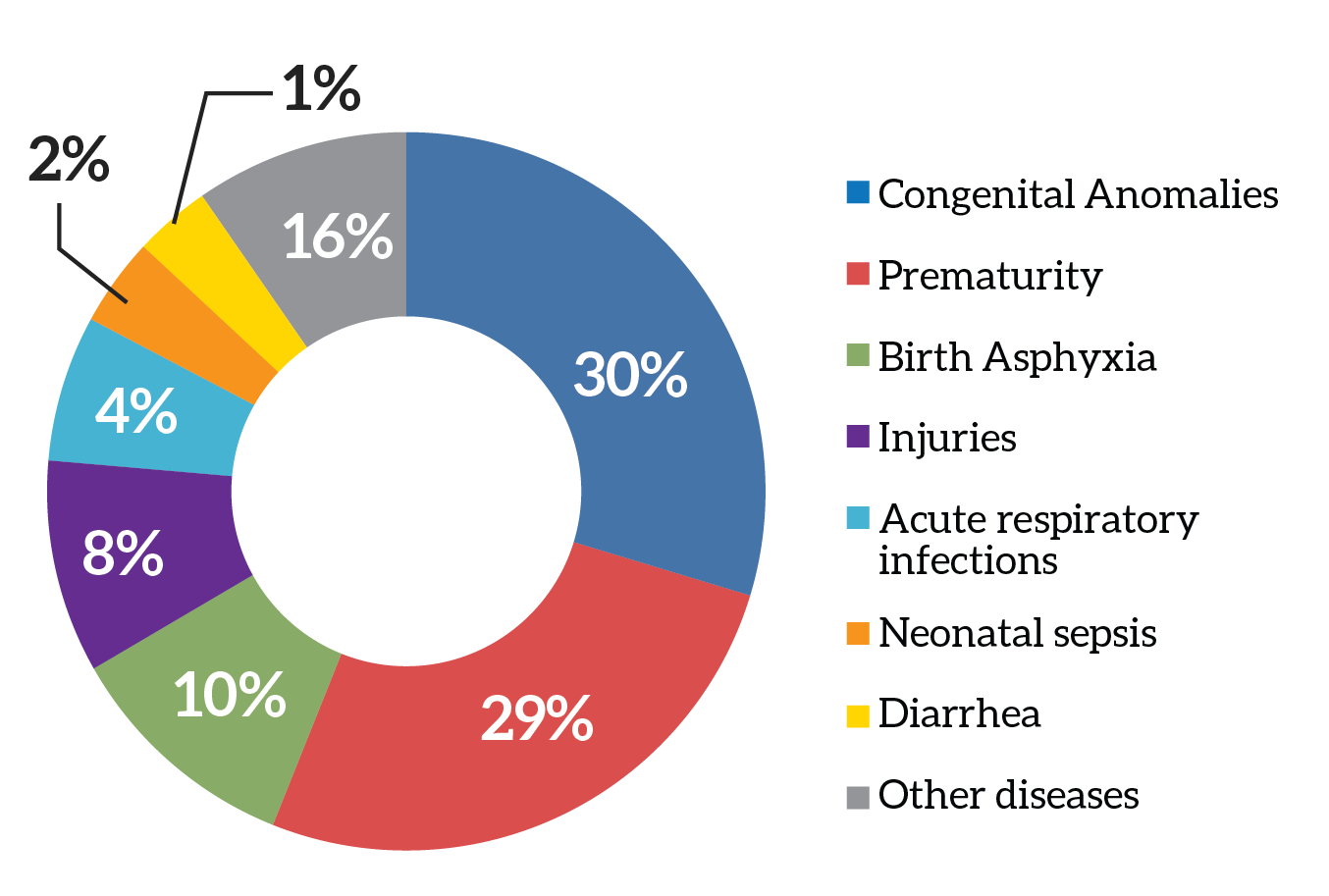

2012 causes of death in children under 5

UAE Healthcare Spending

Management of the nation’s major disease burdens are expected to drive healthcare spending. Health expenditure as a percentage of GDP was 2.8% in 2012 with per capita health expenditure at $1,343. A significant growth is anticipated in the coming years as the ageing population, increasing disposable income, and health awareness of the people will further drive demand for healthcare services.

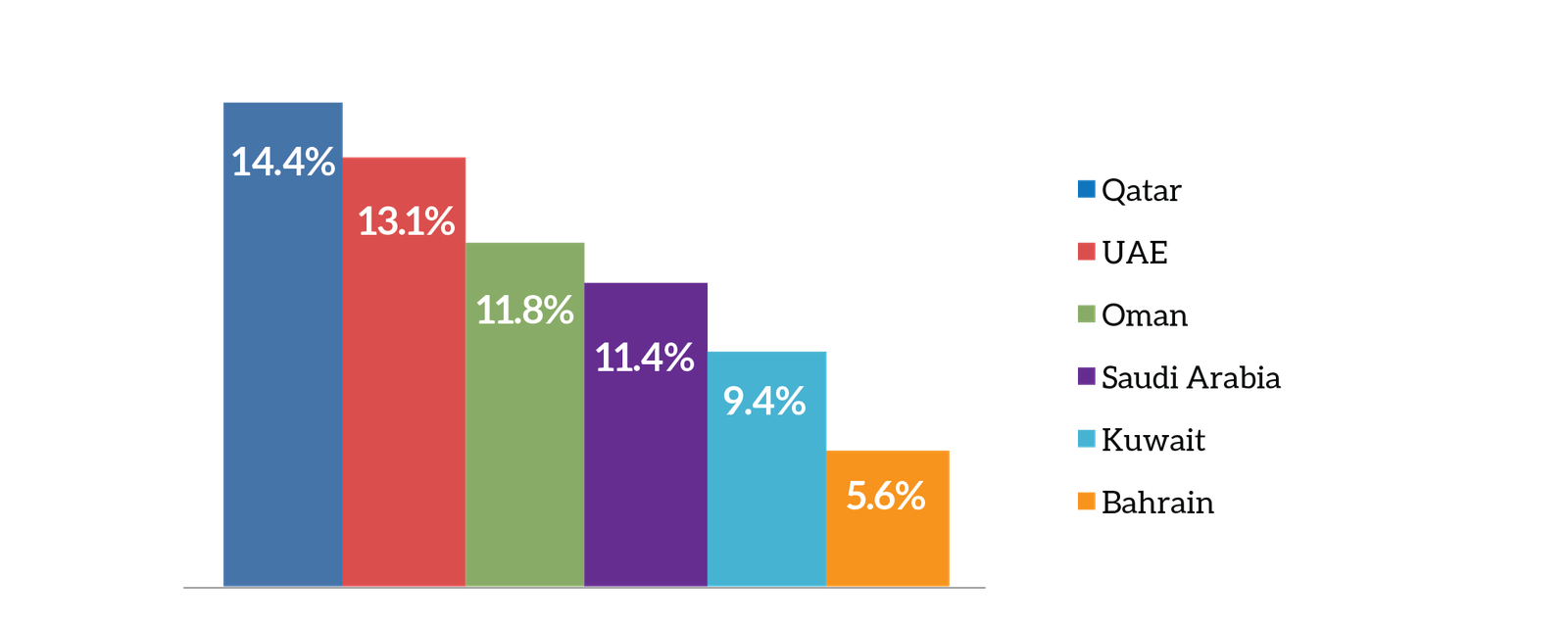

Projections show that UAE will be one of the fastest growing healthcare markets in the Gulf Cooperation Council (GCC) region, rising to $18.6 billion in 2018 from $10.0 billion in 2013. The bulk of this spending will be on out-patient services, estimated to account for ~70% of total healthcare spending.

Projected Healthcare Market Growth in GCC over 2013 to 2018

Health spending puts too much burden on the government, accounting for approximately 74% of total healthcare expenditures. Healthcare is free or at a very low cost to citizens and it is highly subsidized for other nationalities residing in the country. Although favorable economic condition is able to support this scheme, the government nonetheless recognized that there is a need for more sustainable health financing in the country.

UAE Opportunities for Medical Providers

Branded private players are encouraged to participate in the healthcare sector and this is expected to spur competition as well as raise standards of health care provision.

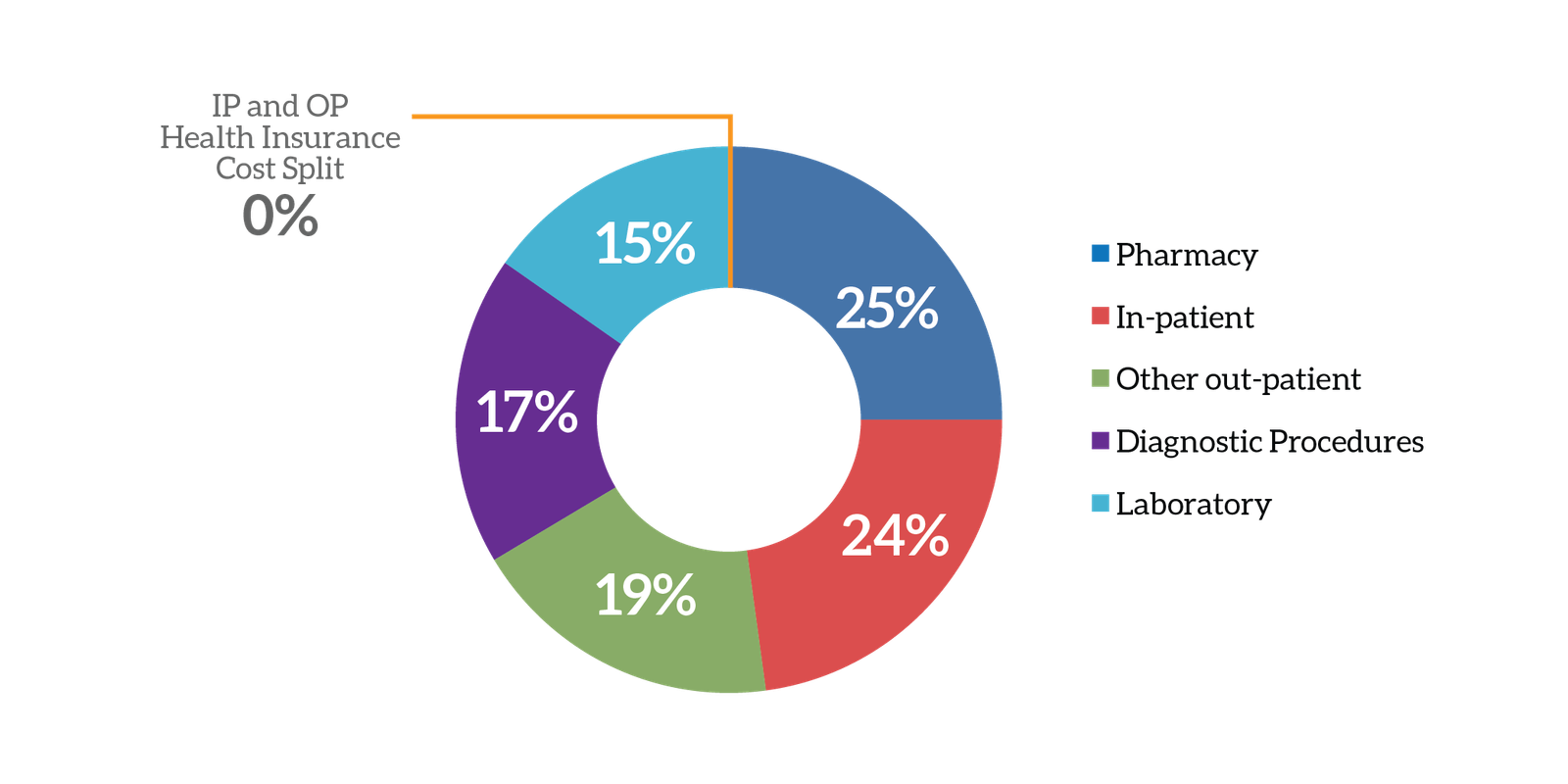

Non-life insurance penetration in UAE was 1.6% in 2012 which is far below the global insurance penetration rate of 2.8%. To close this gap, there are various initiatives that are either currently considered or have already been implemented to increase insurance penetration in UAE. Abu Dhabi requires expatriates and nationals to have insurance, and Dubai is likely to follow. Qatar is also in the process of implementing a compulsory health insurance for all residents and tourists.

IP and OP Health Insurance Cost Split

Along with these initiatives to strengthen the healthcare structure of UAE is its ambition of becoming a preferred destination for domestic patients and a global tourist destination by offering high-quality and cost-effective medical procedures.

Current disease trends and outlook, the economic prosperity and stable as well as inviting political environment of the country point out to a lot of opportunities for medical providers to enter the market, fill current gaps and take advantage of the immense possibilities in this lucrative market.

UAE Healthcare Delivery

Healthcare in UAE is managed by the Ministry of Health which follows a decentralized strategy in providing services to its citizens, with medical districts holding administrative and technical authority in the planning, organization and development of its own healthcare services.

In 2012, there are about 1.1 hospital beds per 1,000 people. One of the government’s focuses is healthcare so it is aggressively developing infrastructure to ensure adequate service provision in the country. With strong economic capacity, UAE has embarked on ambitious healthcare projects, with three major ongoing projects valued at more than US$100 million each. These facilities involving huge amounts of investment are expected to increase medical infrastructure supply as well as raise the quality of healthcare delivery in the country.

The number of hospital beds is expected to reach 21,357 in 2018 at a CAGR of 1.7% from 19,602 in 2013.

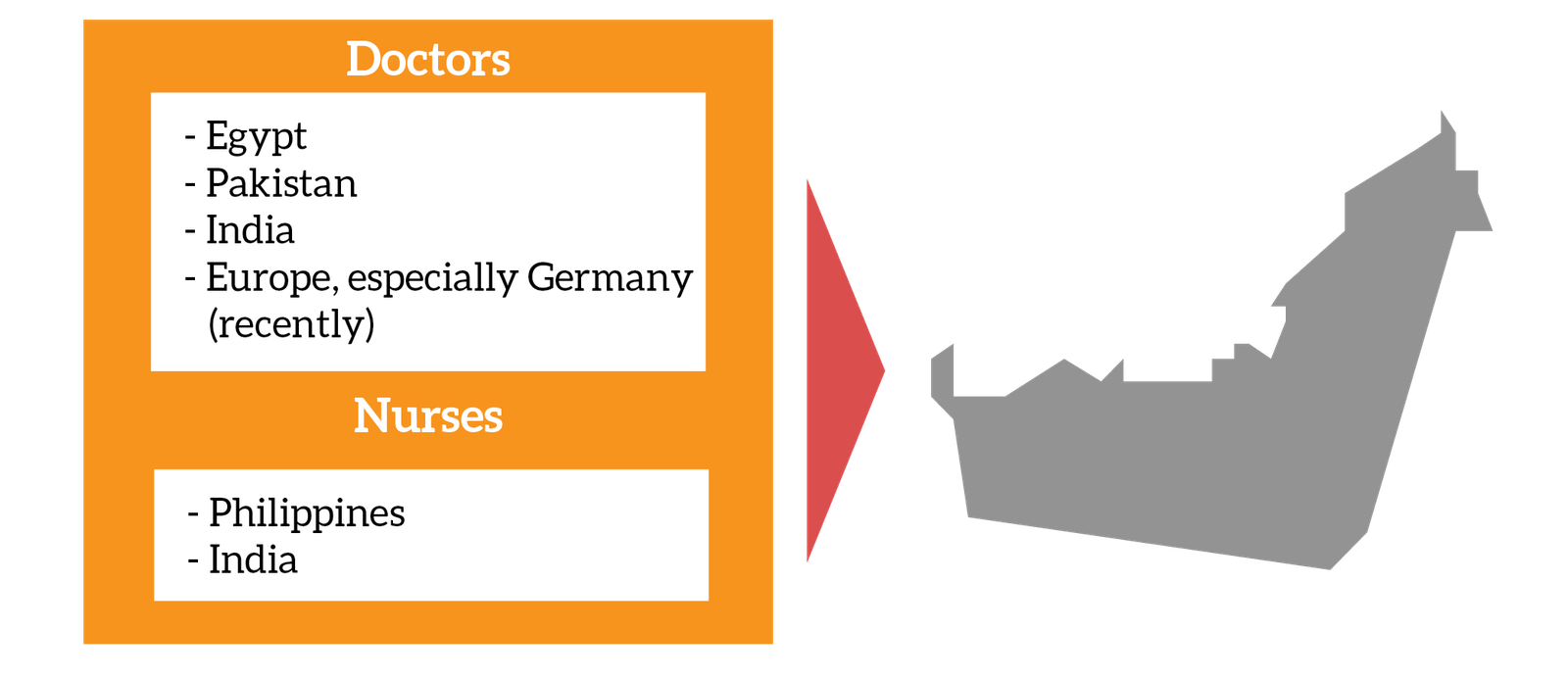

The healthcare infrastructure in UAE however is not yet as established as other developed countries. Availability of health professionals increased over the years. In 2002, the number of physicians, nurses and midwives stood at 17 per 10,000 population, rising 41 by 2011. At these levels, the country is still facing shortages in the workforce, especially in the Northern Emirates. The number of medical graduates is insufficient to support the growing population and the increasing number of hospitals being built. Because of this, foreign staff account for anywhere from 40-80% of healthcare professionals in the UAE.

Nationalities of Majority of Expatriate Workers in UAE

UAE is a medical tourism hub in the region accommodating nationals from the other GCC and Arab countries for their medical service needs. The government seeks to boost its medical tourism efforts further to compete with the already established medical tourism destinations like India. To further promote the attractiveness of the industry, the government has liberalized visa policies as well as increased the number of internationally accredited facilities. The medical tourism sector was estimated to have increased from $1.58 billion in 2012 to $1.69 billion in 2013.

UAE has about 54 internationally accredited healthcare facilities, the highest worldwide.

UAE Pharmaceuticals Industry

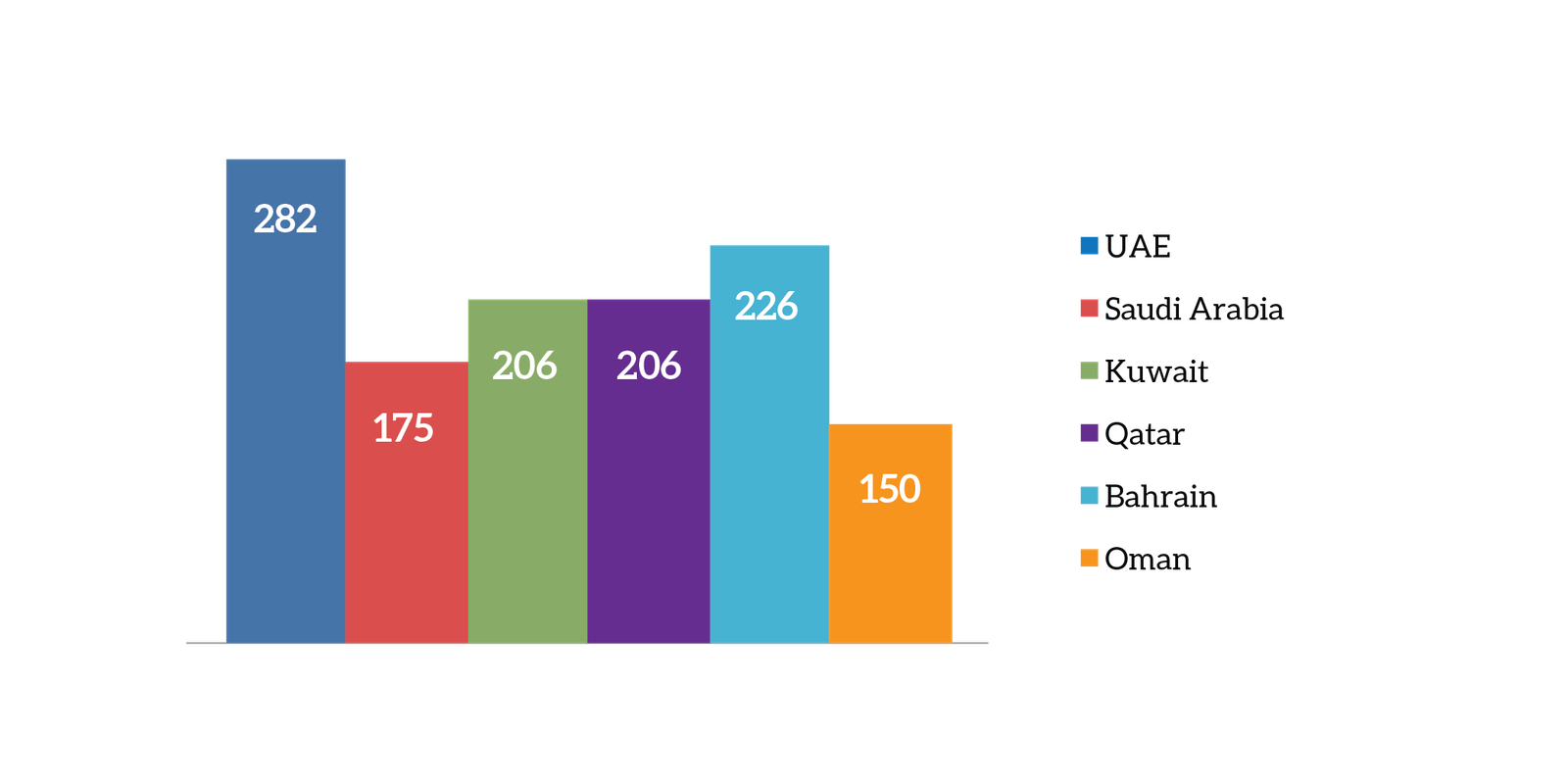

There had been a significant growth in the pharmaceuticals industry of UAE over the years as a result of favorable demographic and economic factors. This is further reinforced by a strong government support to healthcare. The total market size in 2012 was estimated to be $ 1.6 billion, a 3% increase from $1.5 billion the previous year. This accounted for about 18.3% of the total GCC market, second largest in the region after Saudi Arabia. The country’s pharmaceutical sales as a percentage of GDP was 0.4%, lower than the 0.6% average among GCC countries. UAE however had the highest per capita expenditure at $282 as compared to the GCC average of $208.

Pharmaceuticals Sales Per Capita ($)

The country is very dependent on pharmaceutical imports, accounting for about 85% of drugs sold locally. The generally affluent population has a strong preference for branded drugs even after patent expiration and availability of generic drugs in the market. This could be attributed to the belief that imported and expensive medicines are better than the locally manufactured ones. Consequently, generic drugs consumption is low and only accounts for 15% to 20% of the total drug sales.

There are approximately 90 pharmaceutical companies in UAE but only eight companies do manufacturing locally. Leading domestic players include Julphar, Neopharma, Globalpharma, and Medpharma. Most of the latter players produce generic drugs which are exported to Southeast Asia and MENA (Middle East and North Africa) countries. Foreign drug manufacturers are not allowed to sell their products directly in the country and have to go through local importing and distribution companies.

Regulations on drug prescription in UAE are strictly enforced, thus prescribing doctors play a major role in the pharmaceutical industry. Doctors have more familiarity with branded drugs contributing to the strength in sales of such.

As an effort to reduce prices of medicine in the UAE, the government approved a new system in February 2013 that reduced the prices of 6,619 kinds of drugs from 1% to 40%. Incentives are also given to companies that set-up domestic manufacturing plants. In addition, the government encourages the use of generic drugs by restricting advertisement, banning direct marketing and requiring doctors to only prescribe drugs by their molecular name.

UAE Medical Device Industry

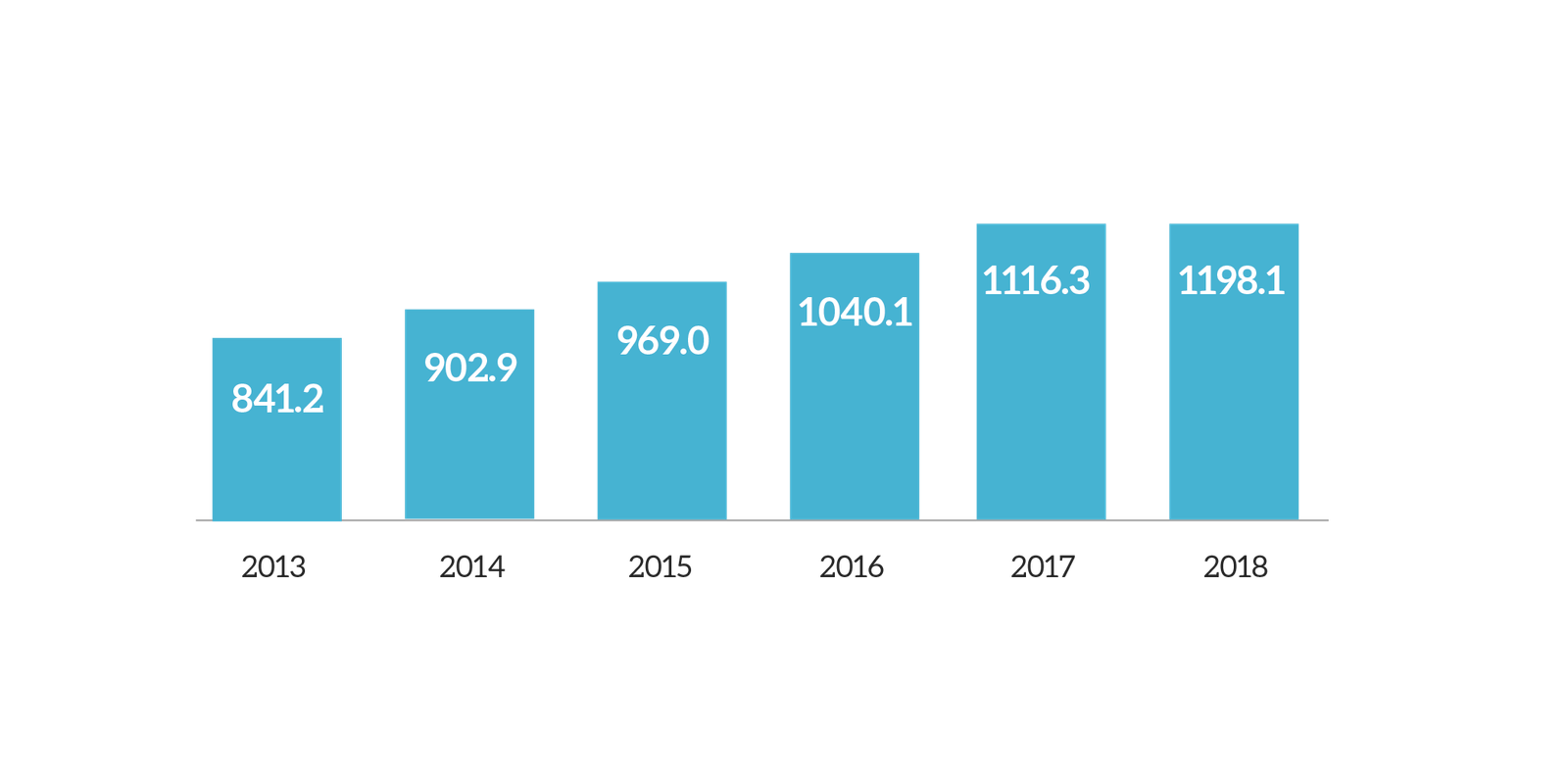

UAE is one of the top 40 medical devices market worldwide. As the country works its way towards becoming a medical tourism hub, the sale of medical devices is expected to surge. The medical device industry was estimated at $841.2 million in 2013, and is projected to reach $1,198.1 million in 2018 at a CAGR of 7.3%. Orthopedics and prosthetics products are expected to have the highest growth while diagnostic imaging will have the lowest growth over this projection period.

Medical Devices Sales Forecast ($ million)

As with pharmaceuticals, the country heavily relies on the import of medical devices. Europe and the Unites States are the major suppliers. Local production, which is estimated to be over $100 million, is limited to basic medical items like syringes, IV sets and other lower-end technology supplies.

Medical devices can be categorized as Class I, Class II A, Class II B, Class III, and active implantable devices. They are subject to regulation by the Drug Control Department of the Ministry of Health and once approved, registration is valid for five years. Regulations are largely based on international guidelines such as Medical Device Regulators Forum, Food and Drug Administration of the United States, European Union Medical Device Directive, EU In-Vitro Diagnostic Device Directive (IVDD), EU Active Implantable Medical Device Directive (AIMDD) and the Global Harmonization Task Force(GHTF).

Challenges

UAE had been heavily dependent on its oil reserves, contributing to its vast wealth but also leaving it vulnerable to shifting global prices. The majority healthcare funding comes from the government but increasing costs in healthcare calls for a more sustainable health financing scheme. The country's high reliance on imported branded drugs and medical supplies makes the prices of these products very high which may prove to be unfavorable to their long-term growth.

Outbound medical tourism is an opportunity lost as about 39% of UAE nationals go out of the country to seek specialized medical services abroad. This is primarily driven by high income levels, growing health awareness of the people and the insufficiency in the number of specialized care facilities in the country. Strengthening local capacity will help to keep this expenditure within the UAE.

For more details on how Eurogroup Consulting can help you to successfully enter UAE and grow your healthcare business, please meet our team or send us an email.

UAE Healthcare Industry Insights

UAE Healthcare Industry Insights