Vietnam is the world's 13th largest country at more than 90 million people, with approximately 60% under the age of 30. This young, vibrant country achieved middle income status and by 2013, GDP per capita had surpassed ~US$1,900, with that figure nearly 2.5 times higher in the country's commercial capital, Ho Chi Minh City.

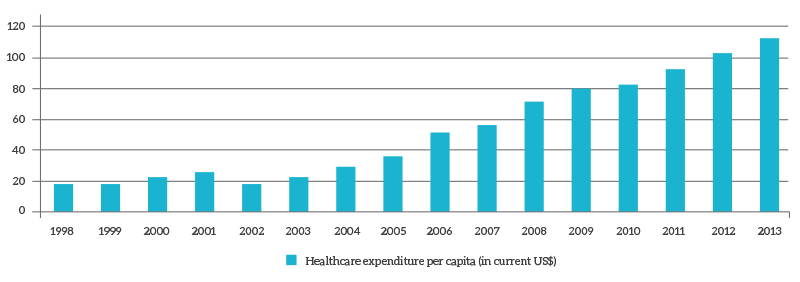

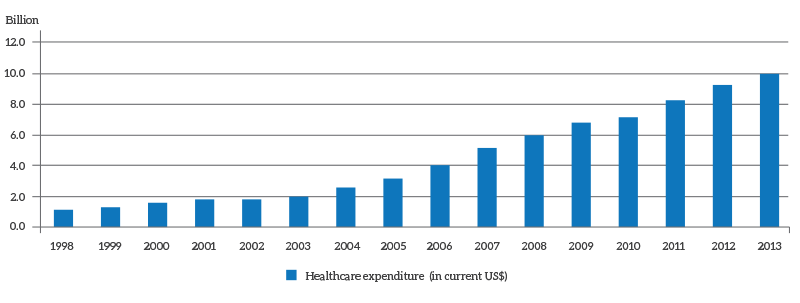

Total healthcare expenditure in Vietnam topped US$10 billion in 2013, or ~6% of GDP, equalling approximately US$115 per person. With the government's effort to achieve universal health insurance by the end of 2014 and with consumer citing healthcare as a priority for disposable income spending, this figure will increase in the years ahead, continuing the strong trend of increasing healthcare expenditure that has been ongoing since 2000, when it increased at a CAGR of ~15% through 2010.

Vietnam Healthcare Delivery

Vietnam has more than 1,100 public hospitals, leading to 31 beds per 10,000 people, the highest proportion in the region. However, due to higher quality of care at facilities in Hanoi and Ho Chi Minh City, hospitals in these two cities treat ~60% of the country's patients, with some hospitals operating at 200% capacity.

Healthcare expenditure per capita (in current US$), 2013

Total Healthcare expenditure (in current US$), 2013

To address overcrowding at a few urban hospitals, the government has worked to improve the quality of care in provincial hospitals through skills trainings and doctor rotation programs, infrastructure upgrades, reimbursement requirements that patients move through the system by referral only, and the liberalization of rules regarding private investment in healthcare facilities.

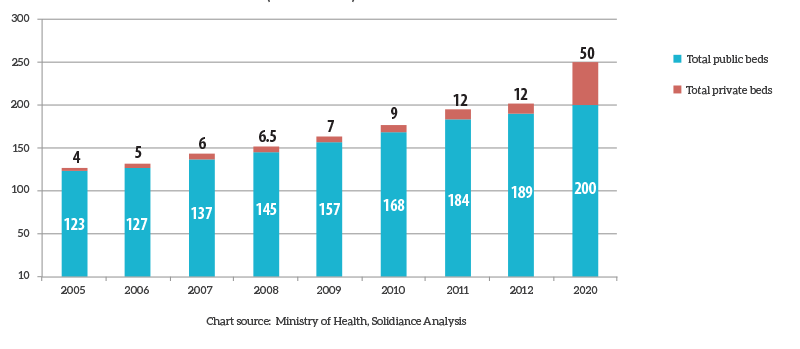

Currently, there are approximately 140 private hospitals in Vietnam, accounting for less than 5% of total hospital beds with nearly 50% of these beds located in Hanoi and Ho Chi Minh City. To support the government's ambitious goal to have private hospital beds account for 20% of total beds by 2020, the government has offered tax incentives and preferential borrowing rates, as well as allocated land in urban areas for hospital development.

Vietnam Pharmaceutical Industry

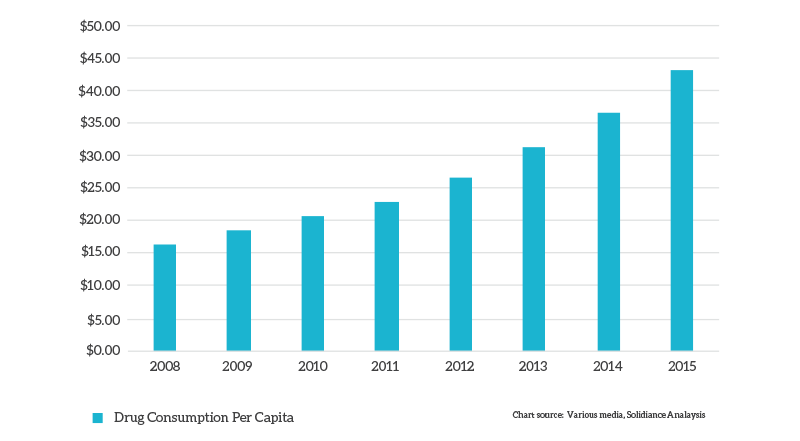

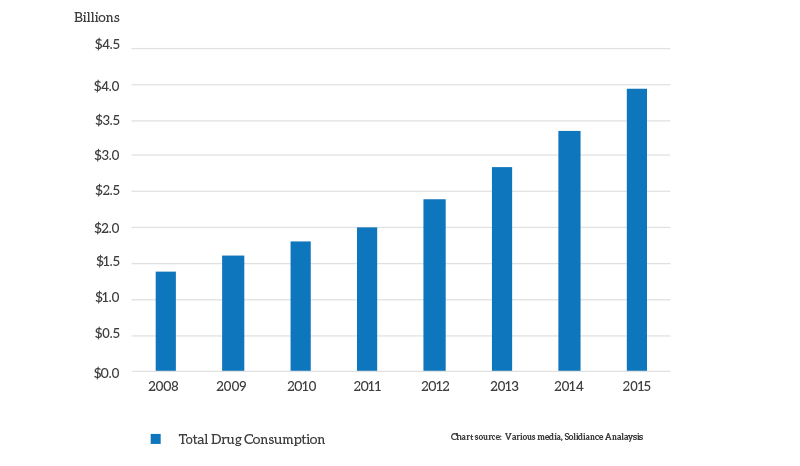

While Vietnam’s ~US$3 billion pharmaceutical market is one of the smallest in the region, it is expected to grow the fastest at ~12%. Per capita, drug consumption reached ~US$33 in 2013, with that figure expected to climb to nearly US$45 by 2015, a figure nearly 3 times that in 2008. With public health insurance coverage expanding and incomes rising, the pharmaceutical industry will see continued strong growth moving forward, especially for drugs aimed at non-communicable diseases such as cancer and diabetes, which are increasing due to lifestyle changes and longer lifespans.

Total Hospital Bed Growth + government target, 2005-2020 (in thousands)

Approximately 60% of the pharmaceutical market is served through hospital tender channels, with two-thirds of that going to out-patients and the remainder to in-patient. The other 40% of the pharmaceutical market goes through pharmacy and commercial channels.

Currently, ~60% of Vietnam's pharmaceutical industry is served by imported drugs though several foreign pharmaceutical companies are expanding their operations into Vietnam due to Vietnam’s high growth potential, including a US$250 million investment from Japan's Nipro Pharma and as a US$75 million investment from Sanofi. For those without local manufacturing, they are not permitted to directly handle distribution unless they have a local manufacturing presence.

Drug Consumption Per Capita, 2008-2015

Total Drug Consumption, 2008-2015

Vietnam Medical Device Industry

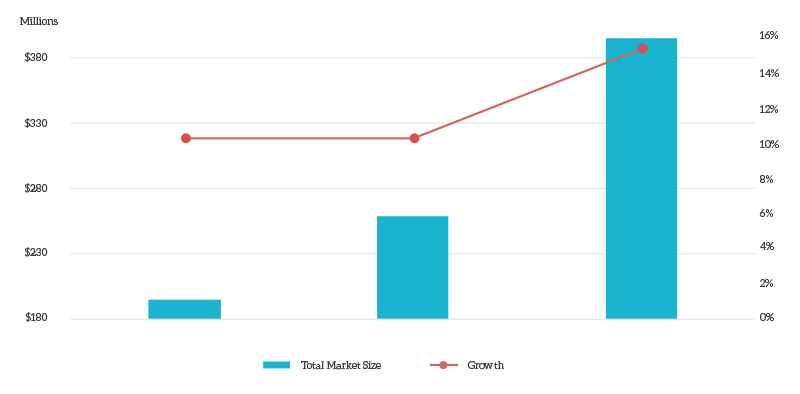

Vietnam's medical device industry reached nearly US$200 million by 2012, with growth expected to drive the industry to more than US$380 million by 2018 as a result of rising healthcare expenditures, government and ODA plans to upgrade rural and provincial hospitals, and expanding hospital infrastructure, in both public and private facilities. Currently, demand from public hospitals represents 70% of overall demand.

Vietnam Medical Device Market Size, 2012-2018

Due to limited local manufacturing capabilities, approximately 95% of the market is served by imports, with lower-value products such as hospital beds and syringes being produced locally. However, while import regulations are not overly complex for medtech companies, distribution is limited to companies with a local manufacturing presence. Otherwise, representative offices must work through local distributors to penetrate the market.

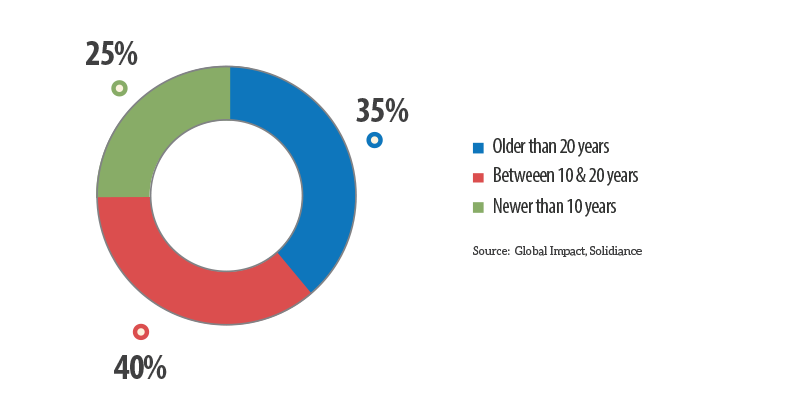

Age of medical equipment stock ( 2013 )

Much of Vietnam's medical equipment is outdated and in need of an upgrade. As of 2013, only 25% of it was less than 10 years old, with 35% of it being more than 20 years old. Further driving medical equipment purchases and upgrades is that many rural and provincial hospitals do not meet the government's quotas for specific medical equipment. As a result, the government and donor agencies such as the World Bank have recently embarked on plans focusing on upgrading these facilities, while also issuing regulations allowing larger hospitals to receive private bank funding for equipment purchases as well as allowing private hospitals increased financial autonomy to increase revenues and medtech financing options.

For more details on how Solidiance can help you to successfully enter Vietnam and grow your healthcare business, please meet our team or send us an email.

Vietnam Healthcare Industry Insights

Vietnam Healthcare Industry Insights