In 2011, India only spends 3.9% of its GDP on healthcare which is equivalent to US$59 per capita, making it one of the lowest healthcare spenders as a proportion of its GDP in the world.

India’s booming middle class brings about great potential for India’s healthcare sector. Currently, the Indian middle class group comprises of 200-300 million individuals but this number is projected to increase to 583 million by 2025. Similarly, the middle class group would be the largest consumer group by 2025, accounting for 59% of India’s total consumption.

As India works towards achieving universal healthcare by 2020, a US$5.4 billion fund was allocated to provide free medicine for all public hospitals countrywide. However, the launch of this policy was delayed because of administrative issues and India’s large bureaucracy. As of 2013, free medication is provided in 15 states as a form of a flagship program.

India Disease Pattern and Burden

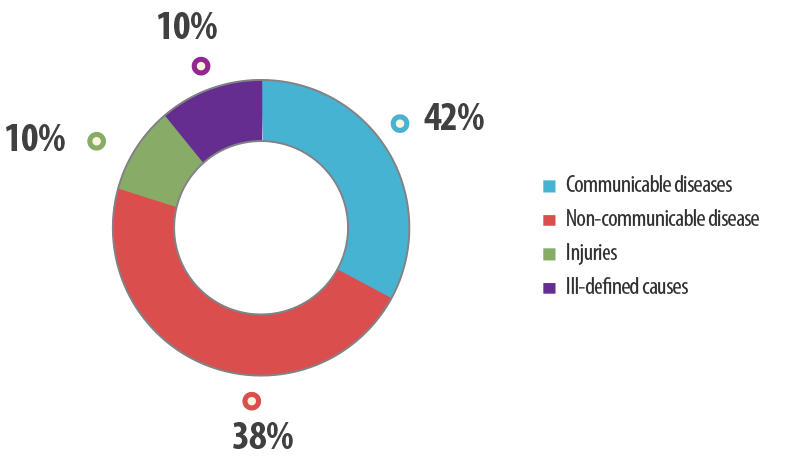

Causes of Death in India (2012)

Both communicable (38%) and non-communicable (42%) diseases have comparable contribution to the mortality rate in India. The main communicable disease burden in India is Tuberculosis (TB) and Malaria. Of the 9.2 million TB cases in the world, 1.9 million are in India. Also, 1.5 million people in India are infected by Malaria each year.

The Indian government has launched the National Tuberculosis Program for over a decade and this has led to a decline in TB cases from 586 cases per 100000 individual in 1990 to 283 cases per 100000 individual in 2007. Also, initiatives such as promoting the usage of long lasting insecticidal nets for prevention and diagnosis kits for diagnosis have saw a reduction of Malaria from 75 million cases in 1950 to 2 million cases today.

India Healthcare Delivery

India’s healthcare sector is worth US$78.6 billion and this number is expected to hit US$158.2 billion by 2017 with a CAGR of 15%. Majority (80%) of the healthcare services in India is provided by the private sector. Due to the high out-of-pocket expenses required for public healthcare and its low quality treatment, locals prefer to seek treatment from private healthcare institutions which are cheaper.

However, in recent years, there are initiatives by the Indian government to improve the affordability and quality of India’s public healthcare delivery such as the National Rural Health Mission and Rashtriya Swasthya Bima Yojana (an insurance policy catered for the poor).

Besides the locals, India is a very popular location for medical tourists from countries like the United States. The current market size of India’s medical tourism industry stands at US$1.2 billion and this number is expected to hit US$1.94 billion by 2015 with a CAGR of 25%. The attractiveness of India as a place for medical tourists due to the falling power of India’s rupee and its low waiting time for surgeries.

However, India may soon lose its position as a medical tourism hotspot if India’s government keeps its strict visa regulations. These regulations have caused medical tourists to travel to neighbouring competitors like Singapore and Thailand for treatment instead. In 2012, India only managed to attract 400,000 medical tourists as compared to Thailand’s 1.2 million and Singapore’s 650,000.

India Pharmaceutical Industry

India’s pharmaceutical market is worth around US$11 billion and is expected to hit between US$20-24 billion in 2015, with a CAGR of 12-14%. India’s pharmaceutical market is dominated by local MNCs which operates globally as well. However, A shift has been observed in focus amongst these Indian pharmaceutical giants in recent years. As India begun following WTO’s GATT and patent laws, new products approvals are becoming increasingly difficult causing these Indian pharmaceutical companies to move out of India’s market.

| Rank | Pharmaceutical Company | Net Sales (2012) |

|---|---|---|

| 1 | Ranbaxy Labs | US$1.24 billion |

| 2 | Cipla | US1.13 billion |

| 3 | Dr Reddy’s Labs | US$1.08 billion |

| 4 | Lupin | US$865 million |

| 5 | Aurobindo Pharma | US$691 million |

| 6 | Sun Pharma | US$647 million |

| 7 | Cadila Health | US$508 million |

| 8 | Jubilant Life | US$426 million |

| 9 | Wockhardt | US$413 million |

| 10 | Ipca Laboratories | US$379 million |

Top 10 Pharmaceutical Companies in terms of earnings (2012)

With the recent launch of the Drug Price Control Order in 2013, it has discouraged entry into India’s pharmaceutical market. This policy has resulted in decreased profits amongst drug makers, retailers and distributors as drug prices of over 340 essential drugs are regulated nation-wide. This is made worse by India’s lack of intellectual property protection. This can be see in the recent granting of license to allow domestic drug makers to manufacture copy cat version of Nexavar (Sorafenib), a cancer drug developed by German pharmaceutical giant, Bayer.

India Medical Device Industry

India’s medical device industry is currently the 4th largest market in Asia and ranks amongst the top 20 in the world. Currently, valued at US$4.4 billion, the Indian medical device market is expected to grow to US$7.8 billion by 2016 with a CAGR of 15.5%.

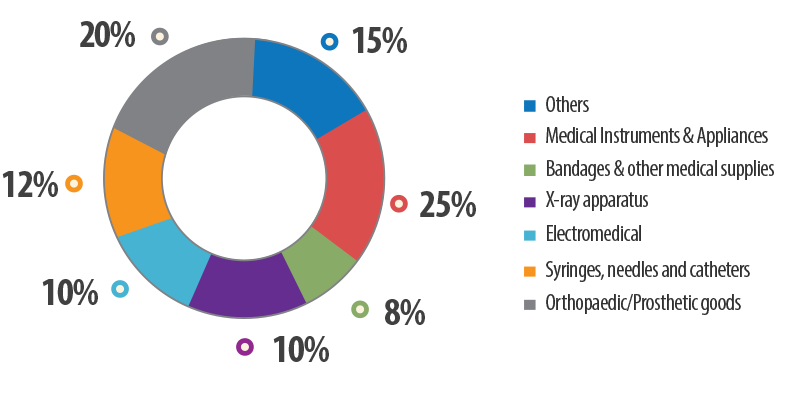

Breakdown of Indian Medical Device Industry (2010)

The Indian medical device industry is highly fragmented, with domestic firms primarily involve in the manufacturing low-technology equipment while MNCs imports high-end medical equipment. Large foreign players includes Johnson & Johnson which holds 55% of the surgical sutures market and local companies like HMD and Sutures India are dominant players in India’s medical device industry.

While India offers cheap labour, it is not an ideal location for manufacturing. This is because the Indian government charges higher duties on raw materials rather than on finished products. For instance, titanium sheet imported for pacemakers have a total import duty of 23.89% while the pacemaker itself has a duty of 9.36%. As such, MNCs typically enter the market via a joint venture with local manufacturers. Yet, with the easing of government regulations, license to import medical devices is more easily attainable, thus MNCs are shifting towards setting up their own subsidiaries in India.

For more details on how Solidiance can help you to successfully enter India and grow your healthcare business, please meet our team or send us an email.

India Healthcare Industry Insights

India Healthcare Industry Insights