Singapore is a renowned regional hub for many healthcare-related sectors, namely pharmaceutical, medical technology and medical tourism. Coupled with the government’s strong commitment towards medical research and advancement, this presents many reasons for healthcare companies to venture into the Singapore healthcare market.

Singapore’s societal demographics also present more opportunities for the healthcare sector. With life expectancy of Singaporean women standing at 85 and men at 80, Singapore is ranked 4th for highest life expectancy in the world.

| Rank | Country | Overall Life Expectancy |

|---|---|---|

| 1 | Japan | 83 |

| 1 | Switzerland | 83 |

| 1 | San Marino | 83 |

| 4 | Italy | 82 |

| 4 | Singapore | 82 |

| 4 | Iceland | 82 |

| 4 | Andorra | 82 |

| 4 | Australia | 82 |

| 4 | Spain | 82 |

| 4 | Qatar | 82 |

Singapore Population Age Distribution

Singapore’s national healthcare expenditure currently accounts for 3.3% of its Gross Domestic Product (GDP). While Singapore has been known to keep its public healthcare expenditure low (with government expenditure kept at 33.1% of total Singapore’s healthcare expenditure), this number is expected to grow with a rapidly ageing population. By 2018, Singapore’s healthcare expenditure market would be worth a huge US$22.3 billion up from 2012’s US$11.7 billion.

SEA Countries' Expenditure on Healthcare (% of GDP and $ Per Capital, year 2011, by World bank)

![SEA Countries' Expenditure on Healthcare [% of GDP and $ Per Capital, year 2011, by World bank]](assets/cart/6.png)

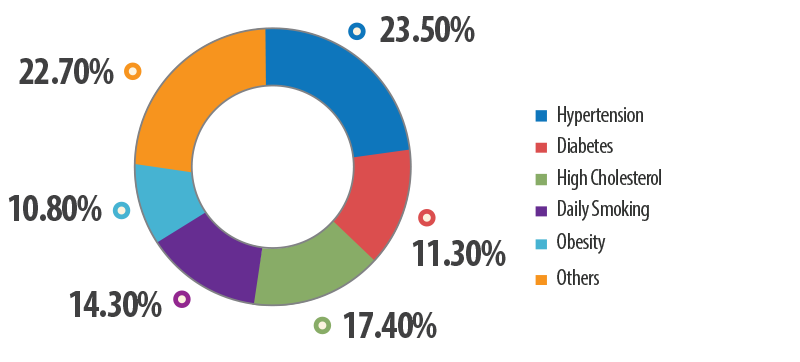

Singapore Disease Pattern and Burden

Singapore, being a country with high sanitation and hygiene level is not very affected by communicable diseases, which arise from poor living conditions. Instead, non-communicable diseases such as hypertension and diabetes that arise from unhealthy lifestyles plague Singaporeans. Initiatives such as increasing awareness towards such diseases have been done through the Singapore’s Health Promotion Board in an effort to reduce Singapore’s disease burden.

Singapore's Disease Burden (amongst adults aged 18-69)

Singapore Healthcare Delivery

In Singapore, private clinics and hospitals cater to 80% of the primary healthcare needs while government polyclinics provide the remaining 20%. However, the reverse applies for more costly hospitalization care; 80% public, 20% private. Locals tend to visit public healthcare establishments over their private counterparts due to its lower fees and at the same time, comparable medical services. However, this popularity has resulted in a longer waiting time (up to a maximum of 3 hours) for beds in public hospitals, a problem that is not really faced by the private hospitals.

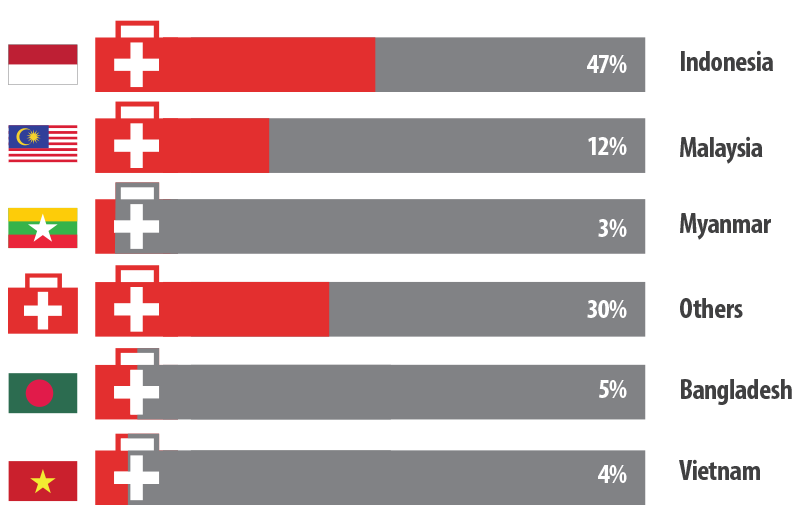

Singapore’s medical tourism industry is definitely something not to be missed with over 850,000 medical tourists arriving in Singapore in 2012 and this number is expected to grow at a rate of 11.9% annually.

Breakdown of 2012 Medical Tourists by country

Medical tourism is where private hospitals are ahead of public healthcare establishment, with Parkway Health Singapore and Raffles Hospital leading the pack. In order to gain a bigger share of the medical tourism pie, Singapore government has been taking measures to direct medical tourists towards public healthcare establishments instead such as tightening its control over land sale to private healthcare groups for setting up of private hospitals. While medical tourism is booming in Singapore, the high barrier entry set by the Singapore government presents a challenge for private healthcare providers and the correct market entry strategy have to be taken up to ensure a smooth entrance in Singapore.

Singapore Pharmaceutical and Medical Device Industry

Over the last decade, Singapore has established itself as the leading pharmaceutical manufacturing hub in Asia. The country’s manufacturing output of pharmaceuticals and biological products grew at an impressive CAGR of 15.8% over the 10-year period from 2001 to 2011. Pharmaceutical products manufacturing also received the highest foreign direct investment in 2011 at US$35.5 billion.

Over the years, Singapore has also tripled its medical technology manufacturing output from US$1.2 billion in 2000 to about US$3.4 billion in 2011, the sector is poised to hit an output of US$4 billion by 2015.

Singapore is a highly desired location for setting up pharmaceutical and medical technology operations due to presence of huge government support. Various funds have been setup to encourage researchers to conduct their research in Singapore. For example, the TCR Flagship Program comes with a 5-year budget of around US$20 million to fund scientists on their research. All these efforts have brought about success with the global top 10 medical technology companies setting up their operations in Singapore.

| Fundings | Description | Amount |

|---|---|---|

| Translational & Clinical Research (TCR) Flagship Programme | For scientists to solve problems and translate research into quality health care solutions | S$25 million (US$19.95 million) for 5 years |

| Competitive Research Programme (CRP) | Fund R&D program that help to identify new potential areas which Singapore can invest in | S$10 million (US$7.98 million) for 3-5 years |

| Health Services Research Competiive Research Grants (HSR-CRGs) | Fund health services research to enable the translation of these research into practice | S$1 million (US$0.8 million) for 2 years |

List of Research Funding Available in Singapore.

For more details on how Solidiance can help you to successfully enter Singapore and grow your healthcare business, please meet our team or send us an email.

Singapore Healthcare Industry Insights

Singapore Healthcare Industry Insights