With 246.9 million people, Indonesia is the 4th country in the world with highest population right after China, India and the United States. Its total GDP was of UD$878 billion in 2012. Indonesia’s healthcare expenditure is only 2.7% of its GDP, which is comparatively lower than its regional counterparts. However the number is projected to grow at 14.9% annually from 2012 to 2018 as the Indonesian government work towards universal healthcare by 2019.

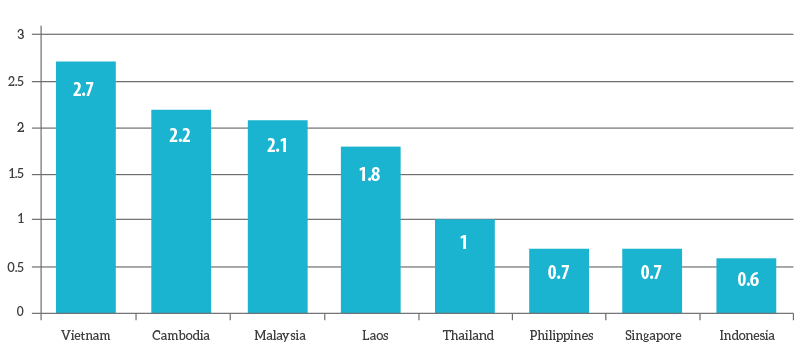

SEA Countries' Expenditure on Healthcare (% of GDP and $ Per Capital, year 2011, by World bank)

![SEA Countries' Expenditure on Healthcare [% of GDP and $ Per Capital, year 2011, by World bank]](assets/cart/6.png)

Indonesia Universal Healthcare Coverage

Since the implementation of the country’s National Social Security System (Sistem Jaminan Sosial Nasional) back in 2004, the Indonesian government has been working towards Universal Healthcare Coverage in 2019. Funds have been directed towards this effort such as a US$2.6 billion kitty which was used to fund the BPJS Kesehatan – a new government body setup to unify the national health insurance system.

The government spending in the insurance coverage scheme would bring about huge financial benefits for Indonesia’s healthcare sector. However, steps taken to launch Universal Healthcare Coverage in 2019 have not been very successful due to financial problems as well as corruption and administrative problems.

Indonesia’s Healthcare System

Indonesia’s healthcare sector is plagued with several issues. Firstly, Indonesia’s healthcare system is faced with a huge lack of medical infrastructure, which stands at 0.6 beds for every 1000 people in 2011. In addition, Indonesia has just 0.4 doctors per 1000 people, lower than the global average of 1.4 doctors.

Hospital Beds per 1000 people (2011)

Secondly, due to the inadequacy of Indonesia’s public healthcare insurance scheme, many patients still have to pay out-of-pocket for treatment and this deterred them from seeking treatment. For example, the government agrees to only allocate US$1.50 per person monthly instead of the required US$2 for insurance premium.

Lastly, with the expansion of national healthcare security, Indonesian government has anticipated a surge of patients in public hospitals and thus is making plans to increase the infrastructure in public hospitals such as a budget of US76.3 million that was set aside for upgrading of public healthcare facilities.

Indonesia Pharmaceutical Industry

Indonesia’s pharmaceutical sector is one of the most attractive markets for pharmaceutical companies looking to expand into the Asia Pacific region.

Indonesia’s pharmaceutical company is worth US$4.5 billion, about the same size as Taiwan. While Taiwan’s market is mature, Indonesia is growing rapidly. Though the country has one of the lowest rates of drug consumption in Asia, spending just US$20 per person in 2010, this number is growing steadily at a projected rate of 9.9% annually.

Currently, local industries hold three-quarter of Indonesia’s pharmaceutical market while the remaining goes to foreign companies. Notably, Kable Pharma, Indonesia’s largest domestic drug manufacturer have 16% market share while GlaxoSmithKline, Bayer and Pfizer together have 9% market share.

Several reasons have made MNCs a minority in Indonesia’s pharmaceutical market. Firstly, local generics are preferred over foreign brands due to their low pricing which is more popular amongst the locals. Similarly, the Indonesian government supports the use of cheaper local generics under the Universal Health Insurance Policy. Lastly, several market access barriers have also been put in place such as the Decree 1010 which was released in 2008 which requires foreign pharmaceutical companies to either manufacture locally or form partnerships with local manufacturing companies in order to register their drugs.

Indonesia Medical Device Industry

Due to Indonesia’s weak currency and cheap labour costs, Indonesia is an attractive location for medical device production. Foreign companies such as CIBA Vision and Smith & Nephew manufacture their equipment in Indonesia for export. In 2010, Indonesia’s medical device market is worth US$500 million and is experiencing a consistent growth of 10-15%.

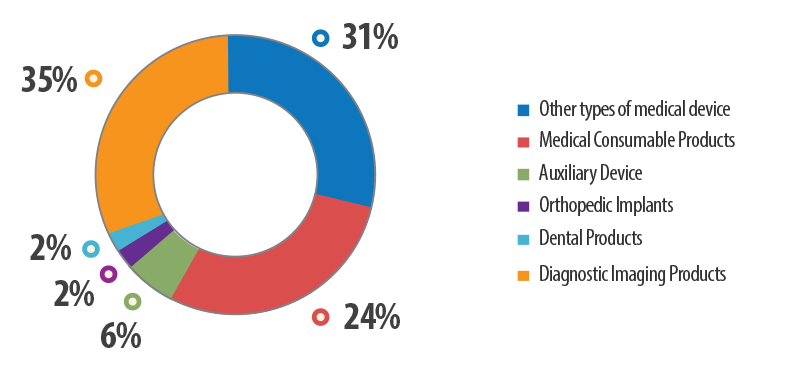

Breakdown of Indonesia's Medical Device Industry (2012)

Diagnostic imaging products and orthopedic implants are the fastest-growing categories in the medical supplies market, and it is estimated to grow from the current market size of US$137 million to US$800 million in 2015.

Currently Indonesia has about 2100 medical equipment distributors but most of them are selling foreign medical equipment. Due to Indonesia’s large geographical territory, foreign brands sometimes appoint more than one distributor for the whole of Indonesia. In addition, more established companies have a network of independent sub-distributor that serve to reach rural or second-tiered cities which are marred with geographical barriers.

Local manufacturers are very limited in terms of production due to a lack of expertise causing 99% of Indonesia’s medical device requirement to be dependent on foreign input.

Challenges

Opportunities definitely do not come without challenges, as businesses entering Indonesia would face the following obstacles.

Firstly, corruption has remained a key issue in Indonesia. Despite steps taken to tackle corruption, Indonesia is still ranked poorly in the 2011 Corruption Perception Index, achieving a rank of 100 out of 183 countries. Secondly, excessive bureaucracy and lack of coordination at the ministerial level also undermined the country’s business environment. Indonesia is ranked 128th under World Bank and IFC’s “Ease of Doing Business” study.

Secondly, the Indonesian government is known for its protectionist tendencies as huge tariffs and protectionist policies are placed on foreign investors so as to protect their local businesses. For example, under the healthcare delivery sector, there is a 67% foreign shareholding limit for hospital management; health assistance services and health care providers as well as a 51% foreign shareholding limit for nursing services in Medan and Surabaya. Furthermore, medical products entering the Indonesian market are faced with tariff of as high as 30%. This high tax makes production of high-end medical products entering Indonesia market very expensive.

Thirdly, Indonesian market has a large bureaucracy and thus obtaining a business license is not easy. It takes an average of 48 days to setup a business in Indonesia which is far above the global average of 24.9.

For more details on how Solidiance can help you to successfully enter Indonesia and grow your healthcare business, please meet our team or send us an email.

Indonesia Healthcare Industry Insights

Indonesia Healthcare Industry Insights