Quality and affordable medical fees have made Thailand the world’s leading country for medical tourism boasting over 2 million medical tourists in 2012 and commanding an annual growth rate of 14% in this sector. It is no surprise that Thailand is given the title of “World’s Most Visited Medical Tourism Destination”. With a GDP of US$365.6 billion that is growing at 6.4% annually, Thailand displays a strong and promising economic outlook for healthcare businesses.

Thailand is currently facing an ageing population and rising mortality rate crisis. In 2013, 9.8%% of the population is 65 years and above and this number is expected to increase to 14.9% in 2030. Also, mortality rate has risen from 6.75 per 1000 people in 2004 to 7.38 per 1000 people in 2010.

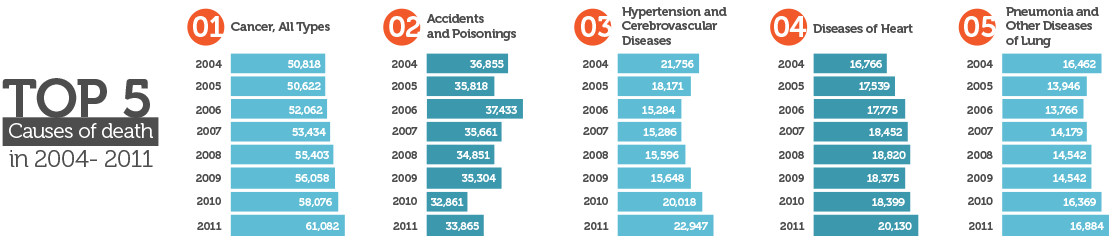

Thailand Disease Burden and Pattern.

There is an increasing number of death from heart diseases and hypertension and stroke diseases. Smaller numbers of death from accidents and poisonings due to more strict regulations from the government and better education about road safety and driving behavior.

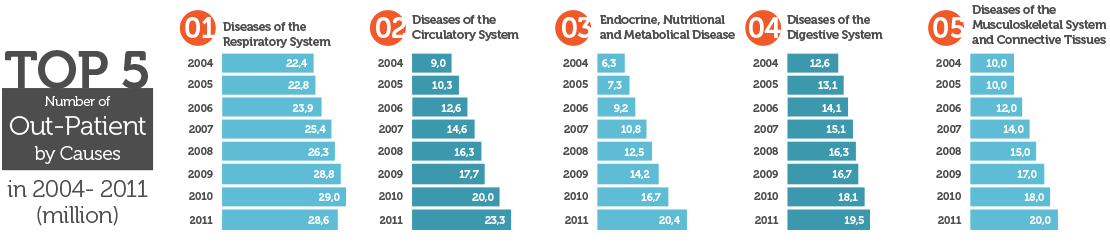

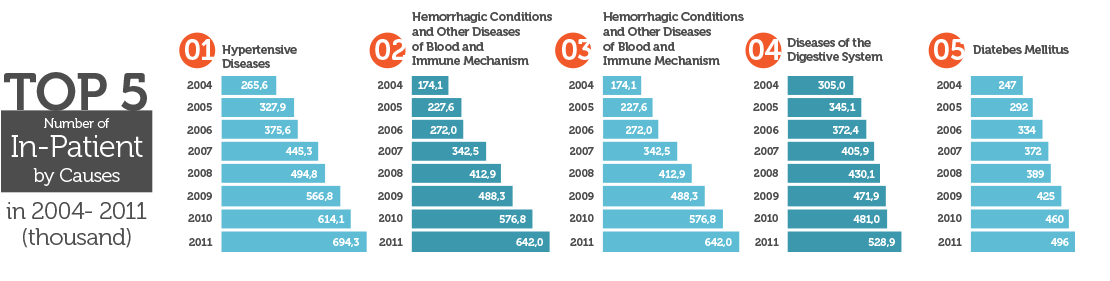

Diseases of the respiratory system is the main cause of OPD visits in Thailand. Number of OPD has an increasing trend as a result of healthcare scheme, covering medical expense of most population.

Endocrine, nutritional and metabolic diseases has the highest growth rate in which the number of patient increases approximately 4 times since 2006. There is a continuously growing trend in all top-five diseases with a rapid change in 2010.

Thailand Medical Tourism.

Thailand Medical Tourism has been growing rapidly over the past 5 years in terms of number of patients and revenue.

Number of foreign patients arriving in Thailand, 2007-2011.

Initiated in 2003 by the controversial former prime minister Thaksin Shinawatra, the Medical Tourism Promotion project highlighted Thailand’s high quality medical services at relatively more competitive prices to developed countries. The Tourism Authority of Thailand sets high growth expectations for medical tourism. It expects the AEC agreements to even boost further foreign patients growth while facilitating the circulation of people within ASEAN Member countries

3 key groups of foreigners:

- Foreign residents

- Tourists

- Visitors seeking specific medical treatments

Popular medical treatments:

- Orthopedics

- Heart Surgery

- Cosmetic Surgery

- Dental Works

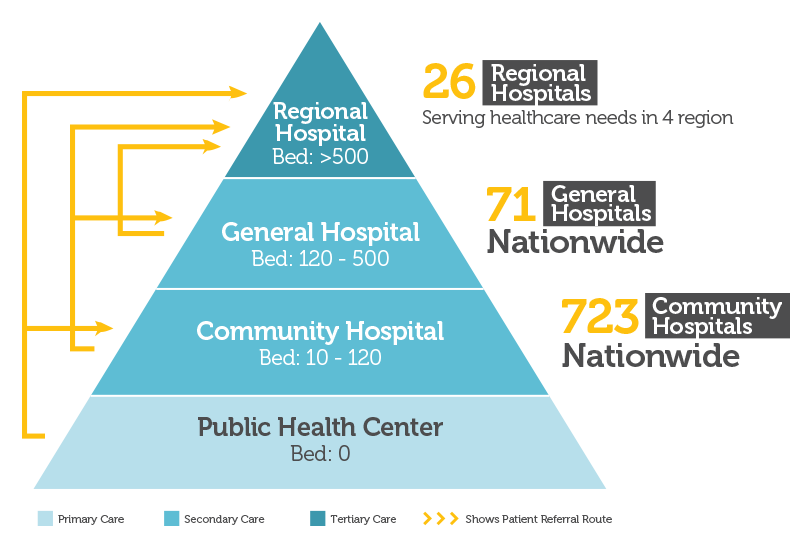

Hospital segmentation in Thailand

Public hospital

The main investment objective of the government is to provide nationwide healthcare service coverage. Hospitals are divided according to sophistication of services. Patients with severe case will be refer to the nearest better equipped facilities.

Private hospital

Currently, there are 321 private hospital nationwide. Similar to other businesses, private hospitals aim to maximize their resource to generate income. Maintaining health and treatment has become key selling point of private hospitals.

Listed-chain Hospital

There are 8 hospital listed in the Stock Exchange of Thailand:

- Aikchol Hospital (AHC)

- BANGKOK DUSIT MEDICAL SERVICES(BGH)

- Krungdhon Hospital (KDH)

- Lanna Hospital(LNH)

- Mahachai Hospital (M-CHAI)

- Ramkhanhaeng Hospital (RAM)

- Samitivej Hospital (SVH)

- Vibhavadi Hospital (VIBHA)

Provincial Private Hospital

- Provincial private hospital are generally mid to small size hospitals, facilitating needs for faster and more comfortable services compare to public hospital

Thailand Summary of key healthcare industry trend and implications.

Thailand Public hospital.

General profile |

||

|---|---|---|

| Medical school | Special regional and general hospital | Other public hospital |

|

|

|

Opportunity for Medical Treatment |

||

|

|

|

Thailand Private hospital.

General profile |

||

|---|---|---|

| Listed-chain private hospital | Provincial private hospital | |

|

|

|

Opportunity for Medical Treatment |

||

|

|

|

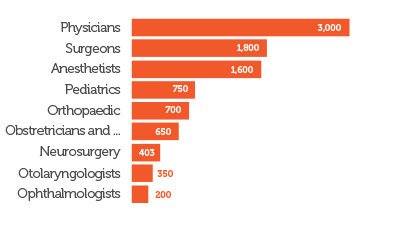

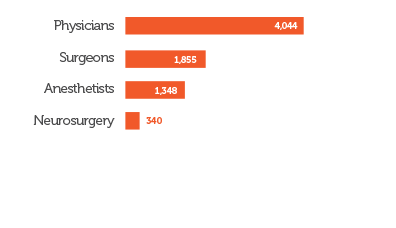

Physicians, Surgeons, and Anesthetists are the top three specialist shortages.

Physicians, surgeons, and anesthetists are on the list of top three specialist shortages for both now and in the 6 years from now. Taking into account, population structure and medical school attendants, physicians shortage will increase significantly due to aging population. Universal health care scheme, expansion of private hospitals, rising numbers of chronic disease patients along with rising expectations to receive treatments from specialists are all aggravating the specialist shortage situations.

Current Medical Specialist Shortage

Future Medical Specialist Shortage, 2019

5,600 Family Physicians required in public hospitals for efficient and effective utilization of medical specialists.

Currently, any patients in Thailand can without any filtering by general practitioners or family physicians, access medical specialists – this led to inefficiency, redundancy, and unnecessary diagnostic and treatments. To increase the efficiency and effectiveness of medical specialists utilization, 5,600 family physicians are needed. Family physician role is to provide primary and secondary care while lessening the burden or tertiary care providers by preventing unnecessary patients access to tertiary care.

For more details on how Eurogroup Consulting can help you to successfully enter Thailand and grow your healthcare business, please meet our team or send us an email.

Thailand Healthcare Industry Insights

Thailand Healthcare Industry Insights